mashroo3k Consulting Company offers a comprehensive feasibility study for an electrical wire recycling plant project in the Sultanate of Oman, offering the highest return on investment and the best payback period. This study is based on a thorough study of the Sultanate’s industrial sector, an analysis of competitors’ strategies, and the provision of competitive pricing.

The electrical wire recycling plant reshapes damaged cables to extract and recycle copper. The plant produces wires with thicknesses ranging from 0.6 mm to 1.6 mm. Recycling projects contribute to eliminating accumulated waste and transforming it into useful and safe products. mashroo3k Consulting Company provides investors interested in investing in an electrical wire recycling plant in the Sultanate of Oman with a set of specialized feasibility studies based on updated databases specific to the Omani market. This helps ensure the project’s success, achieves the highest return on investment, and provides the best payback period.

Galvanized iron sheets in different sizes.<Plain iron plates in different sizes.<Circular iron sections and pipes in different sizes.<Square and rectangular iron sections in different sizes.

Highest-quality products.

Application of approved quality standards.

Application of approved health requirements.

Latest packaging technology.

Management of development and marketing ideas to enhance competitive advantages.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

Technological advancements in the GCC, coupled with population growth, have contributed to an increase in the amount of waste generated from human and industrial activities, among other things. This waste has put GCC governments to a real test; they must address it more quickly to avoid environmental and health problems. The total amount of waste collected (hazardous and non-hazardous) in the GCC is estimated at 131.8 million tons, with 1.2% being hazardous waste and 98.8% being non-hazardous waste. Mashroo3k Economic and Management Consulting would like to present the following key indicators for the recycling sector in the GCC:

The total amount of hazardous waste collected in the GCC amounted to 1.6 million tons.

The total amount of non-hazardous waste in the GCC amounted to 2 million tons.

Collected hazardous waste is divided into: (6% medical waste), (81.8% industrial waste), and (12.2% other waste such as batteries and electronic waste).

Collected non-hazardous waste is divided into: (40.7% construction waste), (25% household waste), (1.7% green waste), and (32.5% other waste).

The amount of treated waste of the total collected waste amounted to 51% (67.2 million tons).

The amount of industrial waste collected in the Gulf Cooperation Council (GCC) countries is equal to 1.3 million tons. It is worth noting that Saudi Arabia and the UAE alone produce 63.1% and 19.3%, respectively, of this total waste.

The amount of non-hazardous waste collected from the household sector in the Gulf Cooperation Council countries amounted to 32 million tons.

The UAE ranks first in the amount of waste treated through recycling, at 42.8%.

The amount of hazardous waste recycled in GCC countries amounts to 100,000 tons (9.3%) of the total hazardous waste treated.

Saudi Arabia leads in solid waste volume, generating more than 16 million tons annually, followed by the UAE with approximately 5.4 million tons annually.

Waste in the Middle East and North Africa is divided into the following:

Food and green waste: 58%

Glass: 3%

Metals: 3%

Paper and cardboard: 13%

Plastic: 12%

Wood: 1%

Rubber and leather: 2%

Other waste: 8%

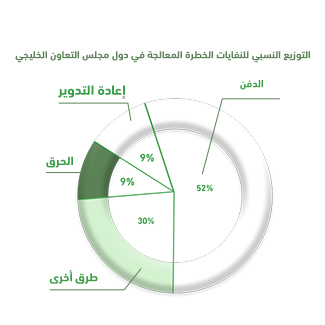

In the GCC countries, hazardous waste is treated by incineration (9%), landfill (51.7%), and recycling (9.3%), with other methods accounting for the remaining 30%.

Non-hazardous waste in the GCC is treated by landfill (51%), while other methods, such as incineration and recycling, account for 49%. Advantages of the circular economy in the GCC:

_ Reducing primary energy consumption by approximately 4%.

_ Creating 50,000 jobs in the recycling sector.

_ Reducing carbon dioxide emissions by 13 million tons annually.

_ Contributing to achieving economic returns of up to $138 billion for the GCC countries between 2020 and 2030.

Recommendations:

Mashroo3k recommends investing in the recycling sector due to the following:

_ The world produces approximately 2.01 billion tons of municipal solid waste, and this volume is expected to reach 3.40 billion tons by 2050.

_ In 2014, global e-waste production reached 12.8 million metric tons, and this figure increased to 53.6 million metric tons by 2019.

Plastic and paper account for approximately 29% of the total global waste and are two promising sectors if invested in through recycling. Below is a breakdown of all waste and its percentage of the total global waste:

Mashroo3kconfirms that the volume of waste in Saudi Arabia now exceeds 45 million tons annually. Given the Kingdom’s determination to increase the recycling rate from 1% to 80% by 2035, the company believes that investing in this vital sector will be highly profitable. Regarding the prospects for the recycling and energy industry, we can mention the following:

In the Kingdom, we could save 45,000 terajoules of energy by recycling glass and metals alone.

3 terawatt-hours of electricity could be generated annually if all food waste in Saudi Arabia were recycled within the walls of biogas plants.

We could generate between 1 and 1.6 terawatt-hours of electricity in Saudi Arabia annually if plastic and other mixed waste (such as paper, cardboard, wood, textiles, leather, etc.) were processed in pyrolysis processes.

Mashroo3k, an economic consulting and market research company, confirms that recycling is a promising sector in the Kingdom and that its projects will offer real investment opportunities, especially after Saudi Arabia moved towards a green economy. Environmental protection and conservation have become priorities for the wise leadership, as clearly reflected in Vision 2030.

The Global Recycling Sector

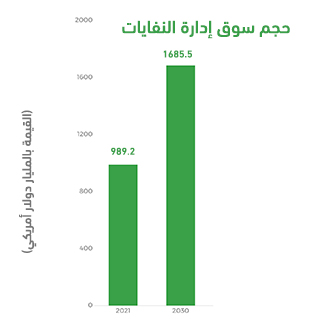

The global waste management market was estimated at approximately $989.2 billion in 2021, and the market is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2022 to 2030, reaching a market value of $1,685.5 billion by the end of the forecast period. It is noteworthy that the Middle East and North Africa region is expected to expand in recycling and waste management at a CAGR of 6.3% between 2022 and 2030. This growth is attributed to increased awareness regarding the sustainable benefits of waste reuse and recycling. Let’s not forget that population growth, increased levels of urbanization, economic growth, and consumption patterns require encouraging investment in this vital sector.