Mashroo3k Economic Consulting Company offers a feasibility study for a medical complex project with the highest return on investment and the best payback period. This study is based on a series of in-depth studies of the healthcare sector in the Sultanate of Oman, an analysis of the strategies of local and foreign competitors, and the provision of competitive pricing.

Mashroo3k Economic Consulting provides investors interested in investing in a medical complex project in the Sultanate of Oman with a set of specialized feasibility studies based on up-to-date databases on the health sector in the Sultanate. This helps ensure the project’s success, achieves the highest return on investment, and provides the best payback period. This is achieved through accurate studies of the size of the Omani market, analysis of the strategies of local and foreign competitors, a study of potential suppliers, and the possibility of obtaining competitive price quotes.

Mashroo3k Economic Consulting Company is committed to ensuring that a medical complex project is staffed with the highest levels of expertise and equipped with the latest equipment. This is in addition to numerous other distinguished services recommended by Mashro3ak consultants, which enhance the medical complex’s competitive advantages, based on accurate studies of the health sector in the Sultanate of Oman.

It features a skilled medical, nursing, and technical staff dedicated to providing excellent service and care to patients.

It boasts a beautiful, creative design.

The building’s walls are treated with antibacterial paint.

The complex’s room doors are fire-resistant.

The rooms are equipped with antibacterial and fire-resistant curtains.

The complex is equipped with a medical waste incinerator to ensure environmental safety.

The complex is equipped with its own electrical generators and an automatic control panel.

The complex is equipped with a fire alarm and extinguishing system.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

Driven by its deep belief in the pivotal role of the healthcare sector in supporting the economy and advancing societies, Mashroo3k presents the most important indicators and key insights for investors interested in launching healthcare projects in the GCC region:

Total Number of Hospitals:

There are 802 hospitals across GCC countries:

Public sector: 58.9%

Private sector: 41.1%

Physician Distribution:

Over 61% of physicians in the GCC are based in Saudi Arabia.

The highest percentage of private sector physicians was recorded in:

United Arab Emirates: 64%

Bahrain: 44.8%

Qatar: 27.1%

The highest percentage of public sector physicians was recorded in:

Kuwait: 79%

Oman: 74.6%

Saudi Arabia: 71.6%

Healthcare Projects:

Approximately 700 healthcare projects are currently under development, with a total estimated value of $60.9 billion.

Of these, 264 projects worth $24.7 billion are under construction.

Digital Health Spending in Saudi Arabia:

Annual spending on digital healthcare infrastructure is expected to grow from $0.5 billion to $1.5 billion by 2030.

Healthcare Expenditure:

Healthcare spending across the GCC is expected to reach $104.6 billion by 2022, up from $76.1 billion in 2017.

Healthcare Inflation:

Average healthcare inflation is projected to decline to 4% in the coming years.

Hospital Bed Capacity Needs:

The GCC region will require approximately 118,295 hospital beds to meet growing patient demand.

Adoption of Advanced Technologies:

Artificial Intelligence (AI) is expected to account for around 30% of hospital investments between 2023 and 2030.

Pharmaceutical and Consumable Manufacturing:

The pharmaceutical manufacturing market is expected to grow to between $8 billion and $10 billion.

The consumables manufacturing market is forecasted to reach $30 billion between 2025 and 2030.

According to United Nations reports, the world population is expected to reach 8.5 billion by 2030, and by 2050, it is projected to rise to 9.7 billion. This population growth will undoubtedly lead to a significant increase in the demand for healthcare services. Therefore, Mashroo3k strongly recommends investing in this vital sector.

It is also noteworthy that global health spending is expected to grow at an annual rate of 3.9% between 2020 and 2024, which is significantly higher than the 2.8% growth rate recorded between 2015 and 2019.

Moreover, the global average number of hospital beds stands at 2.9 beds per 1,000 people, while the number of physicians is 1.8 physicians per 1,000 people. As for nurses and midwives, the number reaches 4 per 1,000 people.

These figures are considerably below the actual demand, emphasizing the urgent need for increased investment in the healthcare sector to meet the growing demand for healthcare services.

Technological advancements have played a crucial role in improving healthcare services worldwide, leading to significantly higher survival rates and better quality of life over the past decade.

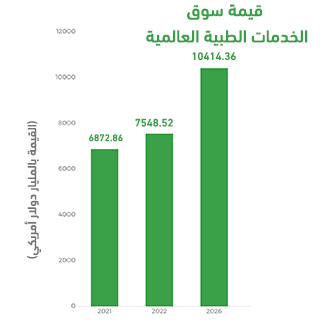

Experts predict that the global healthcare services market will grow from $6,872.86 billion at the end of 2021 to $7,548.52 billion by the end of 2022.

By 2026, the market is expected to experience substantial growth, reaching $10,414.36 billion, with a compound annual growth rate (CAGR) of 8.4% during the forecast period (2022–2026).