Mashroo3k Company offers a feasibility study for a date production and packaging factory project, with the highest profit return and the best payback period, through a series of studies on the industrial sector in the Sultanate of Oman, analyzing the strategies of local and foreign competitors, and providing competitive pricing.

Product quality is the primary factor in determining its competitive capability; therefore, Mashroo3k company includes in the feasibility studies for the date production and packaging factory a set of quality standards that must be met in the factory’s products, according to internationally recognized standards. This helps the product achieve the desired trust with users as soon as it is launched in the markets.

Mashroo3k Economic Consulting Company ensures that the date production and packaging factory project has the latest production lines and advanced packaging technology, in addition to relying on a full operating team that is characterized by the ability to innovate and renew. The factory targets several sectors such as restaurants, hotels, and wholesale and retail traders. …

The date production and packaging factory offers various types of dates, in terms of color, size, and shape, and free from impurities. The factory provides a date sterilization service and packages them in plastic bags after vacuum sealing, ensuring their safe preservation from spoilage for as long as possible, which helps meet the increasing demand in the local and regional markets for processed and canned dates. …

Focus on product and raw material quality.

Use of modern technology and techniques.

Availability of specialized technical staff and skilled workers.

Management with the highest levels of expertise and commitment.

Employment of highly competent workers.

Strict monitoring of the operational process.

Implementation of a comprehensive and strong advertising plan.

Ensuring the product meets human consumption standards.

Adherence to quality standards for packaging materials.

Attractive and safe packaging appearance.

Maintaining a clean production area free of pests.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

The Gulf Cooperation Council (GCC) countries comprise just 0.7% of the world’s population; however, they account for 3% of global spending on processed food and beverages—amounting to USD 102 billion out of a total USD 3.4 trillion. This highlights the region’s exceptionally high per capita food consumption, surpassing the global average.

This is unsurprising upon closer examination: the GCC population now exceeds 58 million people, with approximately 56.3% falling within the 25–54 age bracket—a vital and dynamic demographic that forms the backbone of the food industry market due to its youthfulness and vitality.

Saudi Arabia alone accounts for approximately 59.7% of the GCC’s total population and captures more than 53% of the food and beverage market share in the region. Accordingly, Mashroo3k Company has compiled key indicators of this vital market in the Kingdom, based on the latest available statistics:

By the end of Q2 2021, the number of food product factories was estimated at 916, with an additional 249 factories under construction.

The number of beverage factories stood at 209, with 71 more under construction.

Food product factories represented 11.1% of the total 8,258 operational factories in Saudi Arabia, while beverage factories accounted for 2.5%.

The Saudi food and beverage market was valued at SAR 168.8 billion.

By the end of 2021, food consumption reached SAR 221 billion, marking a 6% growth rate.

According to global reports, Saudi Arabia’s food consumption was valued at USD 70 billion—equivalent to 60% of the total food consumption across the Gulf region.

The fast-food market in Saudi Arabia is projected to reach USD 4.5 billion within the next three years.

The organic, healthy, and specialty food market is valued at USD 27 billion, while the halal food market stands at USD 6 billion.

Saudi Arabia imports approximately USD 14.5 billion worth of food and beverages annually.

In 2020, operating expenses for food and beverage service activities were estimated at SAR 34,032.10 million, up from SAR 30,069.23 million in 2018.

Operating revenues for food and beverage service activities reached SAR 61,557.77 million in 2020, up from SAR 54,866.87 million in 2018.

By 2027, operating expenses for food and beverage service activities are expected to reach SAR 52,489.34 million, while operating revenues are forecast to climb to SAR 92,084.64 million.

Total operating revenues for the food product manufacturing sector in Saudi Arabia are projected to reach SAR 128,540.573 million by 2027.

Global Food Sector Overview:

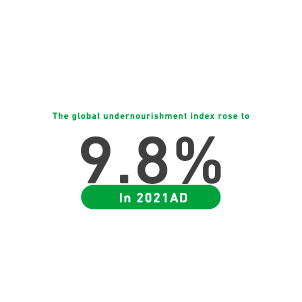

According to UNICEF, the global malnutrition rate rose to 9.8% in 2021.

Between 702 million and 828 million people are suffering from hunger worldwide.

The global food market generates approximately USD 8.66 trillion in revenue.

About 7.8% of global food market revenue is expected to be generated through online sales.

Total global production of primary crops amounts to 9.4 billion tons.

Total global production of red and white meats is 337 million tons.

Total global fruit production is 883 million tons.

Total global vegetable production is 1,128 million tons.

Total global vegetable oil production is 201 million tons.

Total global dairy production stands at 883 million tons.

Total global egg production amounts to 83 million tons.

The fast-food market in Saudi Arabia is expected to reach USD 4.5 billion within the next three years.

The organic, healthy, and specialty food market in the Kingdom has reached USD 27 billion, while the halal food market is valued at USD 6 billion.

Saudi Arabia’s imports of food and beverage products are estimated at approximately USD 14.5 billion annually.

In 2020, operating expenses for food and beverage service activities were estimated at SAR 34,032.10 million, compared to SAR 30,069.23 million in 2018.

Operating revenues for food and beverage service activities reached SAR 61,557.77 million in 2020, up from SAR 54,866.87 million in 2018.

By 2027, operating expenses for food and beverage service activities are expected to reach SAR 52,489.34 million, while operating revenues are projected to reach SAR 92,084.64 million.

The total projected operating revenues for the food product manufacturing sector in Saudi Arabia are expected to reach SAR 128,540.573 million by 2027.