Mashroo3k Company offers a feasibility study for the gypsum quarry project in the Sultanate of Oman, with the highest profit yield and the best payback period, through a series of precise studies of the Omani market size, competitor strategy analysis, and the presentation of competitive price offers.

The project involves establishing a company to exploit one of the gypsum quarries in the Sultanate of Oman. The gypsum quarry project is considered vital due to the multiple uses of gypsum and the fields in which it plays a crucial role. Gypsum is used in agriculture for soil reclamation, is included in foot creams, shampoos, and many cosmetic products, and is utilized in the medical field for dental fillings. Additionally, gypsum is involved in the construction sector, where gypsum boards or drywall are used as finishes for walls and ceilings. Mashroo3k Company provides investors interested in investing in the gypsum quarry project in the Sultanate of Oman with a set of specialized feasibility studies based on updated databases specific to the Omani market, which aids in the success of the project, achieving the highest profit returns, and the best payback period.

Products of the highest quality standards.

Implementation of approved health regulations.

Cutting-edge packaging technology.

A management approach focused on innovative ideas and marketing strategies to enhance competitive advantages.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

Given the strategic importance of the construction sector, Mashroo3k Consulting presents the following key indicators across the Gulf Cooperation Council (GCC) countries:

Construction GDP Contribution: SAR 168.75 billion

Sector’s Share in GDP: 4.66%

Number of Active Companies: 148,026

Number of Employees: 3,541,977

Total Value of Executed Projects: SAR 311.56 billion

Market Position: The Kingdom holds a regional leadership position, with an annual market value exceeding USD 100 billion

Construction GDP Contribution: AED 123.95 billion

Sector’s Share in GDP: 8.3%

Number of Active Companies: 42,428

Number of Employees: 1,564,095

Construction GDP Contribution: BHD 936.79 million

Sector’s Share in GDP: 7.7%

Growth Trend: In 2016, the sector’s value was BHD 857 million, increasing to BHD 945.51 million in a few years

Construction GDP Contribution: OMR 1.943 billion

Sector’s Share in GDP: 6.7%

Number of Employees: 548,999

Employment Share:

Highest employer in Oman, accounting for 22.4% of Omani nationals in both public and private sectors

Represents 29.6% of total expatriate workforce

Construction GDP Contribution: KWD 838.9 million

Sector’s Share in GDP: 2.14%

Number of Active Companies: 1,502

Number of Employees: 187,705

Construction GDP Contribution: QAR 81.215 billion

Sector’s Share in GDP: 12.1%

Number of Active Companies: 5,629

Number of Employees: 840,999

Workforce Share: The sector employs over 40% of the economically active adult population

The construction sector remains one of the most promising investment opportunities in the GCC. With rapid population growth and ongoing infrastructure development, the sector is increasingly attractive to investors and entrepreneurs seeking high returns with lower operational complexity.

Expected Regional Market Growth Rate: 4.2% over the next three years

Forecasted Global Market Size (2023): USD 10.5 trillion

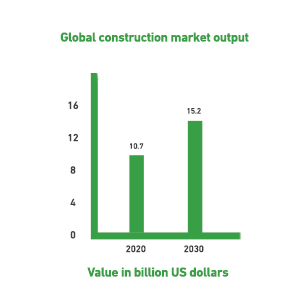

2020 Global Construction Output: USD 10.7 trillion

Forecasted Growth by 2030: +42% (USD 4.5 trillion)

Expected Output by 2030: USD 15.2 trillion

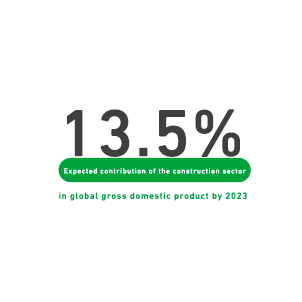

The construction sector contributes approximately 13% to the global Gross Domestic Product (GDP), and this share is expected to rise to 13.5% by 2030.

According to the available statistics, infrastructure is projected to be the fastest-growing subsector within construction, with an average growth rate of 4% between 2020 and 2030.