It is a ready-mixed concrete factory where the project produces ready-mixed concrete, which is a heterogeneous mixture of sand, gravel, cement, and water, with the possibility of adding certain other materials (additives) to achieve specific properties. The proportions of these materials in the concrete mix are selected based on the type of work required and the available materials.

The project involves the establishment of a Ready-Mix Concrete Factory, which produces concrete as a non-homogeneous mixture of sand, gravel, cement, and water, with the option of adding other materials (admixtures) to achieve specific properties. The proportions of these components are carefully selected based on the type of application and the availability of materials.

When mixed, these components begin to gradually harden over time, resulting in a strong and durable material. The final strength of the concrete depends on the quality of the raw materials, mixing method, and the curing process, which may involve the addition of chemical enhancers.

The idea behind the project stems from the increasing and continuous demand for ready-mix concrete, driven by the rapid expansion in various industrial and housing sectors. The current wave of urban development and infrastructure growth has made ready-mix concrete an essential component in construction.

Moreover, the availability of key raw materials—cement, sand, gravel, and additives—ensures stable production operations, enhancing the project’s feasibility.

The main objective of the project is to meet the growing local demand for ready-mix concrete, supporting sustainable development and taking advantage of the ongoing urban boom.

The project targets the local market, specifically:

Contracting companies

Real estate investment firms

Individual contractors

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

Given the strategic importance of the construction sector, Mashroo3k Consulting presents the following key indicators across the Gulf Cooperation Council (GCC) countries:

Construction GDP Contribution: SAR 168.75 billion

Sector’s Share in GDP: 4.66%

Number of Active Companies: 148,026

Number of Employees: 3,541,977

Total Value of Executed Projects: SAR 311.56 billion

Market Position: The Kingdom holds a regional leadership position, with an annual market value exceeding USD 100 billion

Construction GDP Contribution: AED 123.95 billion

Sector’s Share in GDP: 8.3%

Number of Active Companies: 42,428

Number of Employees: 1,564,095

Construction GDP Contribution: BHD 936.79 million

Sector’s Share in GDP: 7.7%

Growth Trend: In 2016, the sector’s value was BHD 857 million, increasing to BHD 945.51 million in a few years

Construction GDP Contribution: OMR 1.943 billion

Sector’s Share in GDP: 6.7%

Number of Employees: 548,999

Employment Share:

Highest employer in Oman, accounting for 22.4% of Omani nationals in both public and private sectors

Represents 29.6% of total expatriate workforce

Construction GDP Contribution: KWD 838.9 million

Sector’s Share in GDP: 2.14%

Number of Active Companies: 1,502

Number of Employees: 187,705

Construction GDP Contribution: QAR 81.215 billion

Sector’s Share in GDP: 12.1%

Number of Active Companies: 5,629

Number of Employees: 840,999

Workforce Share: The sector employs over 40% of the economically active adult population

The construction sector remains one of the most promising investment opportunities in the GCC. With rapid population growth and ongoing infrastructure development, the sector is increasingly attractive to investors and entrepreneurs seeking high returns with lower operational complexity.

Expected Regional Market Growth Rate: 4.2% over the next three years

Forecasted Global Market Size (2023): USD 10.5 trillion

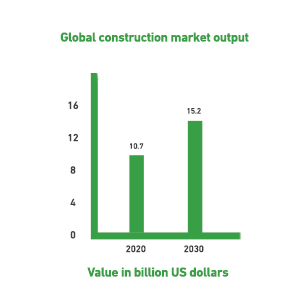

2020 Global Construction Output: USD 10.7 trillion

Forecasted Growth by 2030: +42% (USD 4.5 trillion)

Expected Output by 2030: USD 15.2 trillion

The construction sector contributes approximately 13% to the global Gross Domestic Product (GDP), and this share is expected to rise to 13.5% by 2030.

According to the available statistics, infrastructure is projected to be the fastest-growing subsector within construction, with an average growth rate of 4% between 2020 and 2030.