It is a factory for plastic wood products where the factory produces internal doors, windows, chairs, tables, and kitchens in various sizes according to the specifications required by clients in terms of thickness, dimensions, and design.

The project is a factory for plastic wood products, where the factory produces interior doors, windows, chairs, tables, and kitchens in various sizes according to the specifications required by customers in terms of thickness, size, and shape. The plastic wood industry relies on a special blend of plastic components with natural fibers from wood or secondary agricultural products. After being specially processed and prepared, they are blended to integrate effectively with the plastic through innovative mixing methods. This creates a product with dual benefits (combining the properties of both plastic and wood). The plastic components protect the wood from water and insects, while the wood shields the plastic from ultraviolet rays. The new product is characterized by a combination of the texture and rigidity of plastic with the durability of wood. These products are lightweight, strong, and durable, produced using the latest technological methods and the best machinery and equipment, relying on top production lines. This enables the factory to compete with local producers and meet the growing demand for the product. The project targets several sectors, including construction, furniture stores, and residential homes.<br><br>

Utilization of industrial technology.

Use of high-quality raw materials.

The plastic wood industry relies on experts and technicians.

Increasing the local production of plastic wood.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

The Plastic Sector in the GCC Countries

In 2020, the global plastic market was estimated at around 579.7 billion USD and is expected to reach 750.1 billion USD by 2028, with a compound annual growth rate (CAGR) of 3.4%. Regarding the GCC region, the plastic industry has grown in recent decades, driven by governments’ desire to diversify their economies and reduce reliance on oil and gas as the sole sources of income. Additionally, the rising demand for plastics in industries such as automotive, packaging materials, construction, and water pipes has been another factor contributing to the growth of this vital industry. A report by the Gulf Petrochemicals and Chemicals Association (GPCA) indicated that plastics are the second-largest industrial sector in the region, with products worth up to 108 billion USD. For those interested in exploring the indicators of this industry in Saudi Arabia, “Mashroo3k” will present specific points that can serve as a guide in your investment journey, based on the latest available statistics:

Saudi Arabia accounts for nearly 72% of the GCC’s plastic production and its industries. The Gulf region, as a whole, represents 9% of the global plastic industry.

Saudi Arabia ranks 8th globally in plastic production, holding 2% of the global polymer production.

By the end of Q2 2021, there were over 222 rubber and plastics factories in Saudi Arabia, representing 11.9% of the total number of operating factories in the Kingdom.

According to the Harmonized System for International Trade classification, Saudi Arabia’s exports of “Plastics in Primary Forms” were valued at 67,824,000,000 SAR, with a weight of approximately 16,978 tons. For “Plastics in Non-Primary Forms,” the value of these exports was estimated at 2,403,000,000 SAR, with a weight of 384 tons.

In Q2 2020, the value of exports of plastics, rubber, and their products was around 13,723,000,000 SAR, which increased to 22,491,000,000 SAR in Q2 2021.

Operating expenses for rubber and plastic product manufacturing activities now exceed 10,103,147,000 SAR, while total revenues for these activities reached 20,148,798,000 SAR.

Operating expenses for rubber and plastic product manufacturing are expected to rise to 20,264,052,000 SAR by 2027, while operating revenues for these activities are anticipated to reach 32,477,785,000 SAR in the same year (2027). This represents an expense growth rate of 8% and a revenue growth rate of 5.4%.

In conclusion, “Mashroo3k” confirms that global demand for plastics will triple by 2050, and the data we have indicates an increase in plastic consumption among individuals in the GCC countries, with per capita consumption of plastic estimated at around 94 kg/year, according to the latest available statistics.

According to the Organization for Economic Co-operation and Development (OECD), the total global plastic production reached 234 million metric tons in 2000 and has since grown to 460 million metric tons, marking a significant expansion in the sector. As a result, “Mashroo3k” advises investing in this sector, especially considering that global plastic waste has increased from 156 million metric tons in 2000 to 353 million metric tons in 2019.

Global Plastic Sector

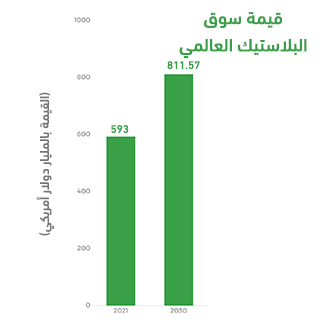

The global plastic market was valued at 593 billion USD in 2021. By the end of 2022, the market value is expected to reach 609.01 billion USD. The market will expand at a compound annual growth rate (CAGR) of 3.7%, and by the end of 2030, the market value is projected to reach approximately 811.57 billion USD.