mashroo3k Economic Consulting Company offers a feasibility study for a business application and brokerage services project, with the highest return on investment and the best payback period. This study is based on a series of in-depth studies of the Omani market size, an analysis of local and foreign competitors’ strategies, and the provision of competitive pricing.

The Business and Brokerage Services app provides real estate and residential unit rental services for individuals and companies, as well as car rental services. The Business and Brokerage Services app acts as an intermediary between apartment, villa, and house owners and other individuals and companies in need of rental services.

The Business and Brokerage Services application is compatible with all smartphone devices and presents its services in a simple and clear manner, noting that rental services are available (by the day, week, or month). Mashroo3k Economic Consulting Company is keen to ensure that its successful Business and Brokerage Services application project provides the best real estate and residential unit rental services for individuals and companies, in addition to other services that Mashroo3k consultants are keen to provide to help investors interested in investing in the e-commerce sector identify the best methods and approaches to develop their project’s services and enhance its competitive advantages.

Compatible with all Android and iOS phones.

The control panel is available in both Arabic and English.

The app interfaces are designed to be user-friendly and distinctive.

Easily add or block new customers using their phone numbers.

Option to receive service fees either in cash or via electronic payment (MasterCard or Visa).

Receive complaints and respond to customer messages.

Announce new services by sending bulk notifications to customers.

Access customer ratings for each service and the employee who performed it.

Ability to chat with customers via text.

Protection against tampering or hacking, as it is equipped with top-level security features.

24/7 technical support service available.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

In 2015, e-commerce contributed approximately 0.4% of the GCC’s GDP, amounting to $5.3 billion.

In 2020, with the developments brought about by the coronavirus pandemic on the global economy, the e-commerce market in the GCC became one of the fastest-growing markets in the world, with a growth rate exceeding 35%. The size of this market was estimated at approximately $24 billion, compared to expectations of $21.6 billion.

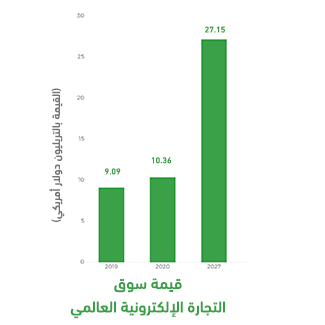

Here is a detailed look at the size of the e-commerce market in the GCC over the past five years:

Global reports predict that e-commerce in the GCC will grow at a faster pace during (2020-2022) by 20%, and by 14% until 2025. Were it not for COVID-19 and its consequences, the figures would have been 14% and 10%, respectively. The average percentage of households purchasing goods online has increased from 2% to more than 8%. In developed countries such as the United States, Korea, and Germany, this percentage ranges between 16% and 25%. However, indicators predict that the percentage will rise in GCC countries to match global rates.

Online visits to popular shopping sites increased by 50% in 2020 compared to 2015, with the number of visitors reaching 21 million, up from just 3 million.

Recently, the number of shopping platforms and related online applications has tripled compared to 2015.

The time users spend on sites like Amazon, Namshi, and Noon has increased, with the average daily time spent on them ranging from 9 to 12 minutes, and the number of pages viewed ranging from 7 to 8. Food and grocery delivery services are among the fastest-growing e-commerce segments, with a growth rate of 20% and a market valued at over $3 billion in the GCC.

Fashion and beauty represent a significant investment opportunity in this sector, with a growth rate of 18% and a market valued at over $5 billion in the GCC. Here’s a detailed look at the e-commerce market growth forecasts in the GCC (over the next five years):

60% of millennials shop online.

By 2025, the e-commerce market in the GCC is expected to reach $50 billion.

Millennials represent over 45% of the GCC population, making the e-commerce market a promising market in the region.

E-commerce revenues are expected to reach $8.29 billion by 2024.

In 2019, the number of internet users engaged in e-commerce (buying or selling) in the Kingdom reached 23.7 million, and this number is expected to rise to 33.6 million, an increase of 42%.

Clothing, shoes, and sporting goods are the most popular items purchased online, accounting for 67% of all e-commerce purchases. Cosmetics come in second place with 25.9%, followed by books and magazines with 24%, and IT services with 16%. Other goods account for the remaining share.

With the spread of the coronavirus, the number of e-commerce stores in the Kingdom increased by 12.4%, reaching 28,676 stores (by the end of the first half of 2020), up from just 25,501 in the fourth quarter of 2019.