A cosmetics company is one of the most promising projects that responds to the needs of a continuously growing market. It offers a wide variety of products designed to enhance facial beauty, improve skin texture, care for hair, and highlight the appearance of lips and nails. With the increasing awareness of personal care and the growing demand for products that combine quality and innovation, cosmetics companies have become an attractive investment option that blends creativity and profitability. This type of business stands out for its flexibility and ability to target a wide range of customers by developing products suitable for different age groups. The company can further enhance its appeal by launching specialized product lines, such as natural cosmetics or products free from harmful substances, catering to the needs of health-conscious and sustainable product-focused consumers. Additionally, the project offers vast expansion opportunities by opening new branches in both local and international markets, as well as establishing strategic partnerships with distributors and retailers. The company can also strengthen its market presence by participating in specialized trade fairs, contributing to increased brand awareness, expanding the customer base, and enhancing opportunities for sustainable growth.

The cosmetics company is a pioneering project characterized by offering high-quality products that meet the diverse needs of customers. The company provides a wide range of products, including skincare creams, hair care products such as shampoos, conditioners, and nourishing oils, as well as cosmetics like lipsticks, foundation, and eyeshadows, in addition to nail care products and luxurious perfumes. The company also features products from the most renowned global brands that are trusted by customers. The project is based on several competitive factors, the most prominent of which is the commitment to delivering high-quality products supported by comprehensive guarantees to ensure customer satisfaction. The company relies on competitive pricing strategies that make it the ideal choice for those seeking the best value for their money. A team of specialized experts works to provide an exceptional experience, including after-sales services to ensure complete customer satisfaction. Furthermore, the company is committed to sustainability standards by using eco-friendly packaging materials, reflecting its responsibility and belief in promoting sustainability.

Product quality.

A wide range of products from the most famous global brands.

Competitive prices.

A highly skilled team.

After-sales service.

Product guarantees.

Use of eco-friendly packaging materials.

Executive summary

Study of project services/products

Market Size Analysis.

Technical study

Financial study

Organizational and administrative study

The Service Sector in the Gulf Cooperation Council (GCC) Countries

According to macroeconomic sector theory, the economy is divided into three main sectors:

The first sector involves the extraction of raw materials and includes mining companies, logging companies, oil exploration firms, agricultural industries, and fishing activities.

The second sector is focused on goods production and sales, such as the automotive industry, furniture manufacturing, clothing trade, and similar activities.

The third sector, known as the “services sector,” is responsible for providing and producing services, primarily relying on intangible elements such as entertainment, healthcare, transportation, hospitality, and restaurants.

The theory suggests that as countries become more developed, their economies increasingly rely on the third sector, in contrast to less-developed countries that depend largely on the first sector. (For example, the services sector accounts for approximately 85% of the U.S. economy.)

Saudi Arabia:

The service sector in Saudi Arabia is highly significant, encompassing: wholesale and retail trade, restaurants and hotels, transportation, storage, information and communications, financial services, insurance, real estate, business services, social, community, and personal services, as well as government services. Key indicators of the sector include:

The service sector contributes approximately 48.2% to Saudi Arabia’s GDP.

The “wholesale and retail trade, restaurants, and hotels” segment accounts for 10.8% of the GDP.

The “transportation, storage, information, and communications” segment contributes 6.6%.

The “financial services, insurance, real estate, and business services” segment represents 6.4% of the GDP.

The “community, social, and personal services” segment contributes 2.5%.

Government services contribute 21.9% to the GDP.

Saudi Arabia issued 100,944 new commercial licenses last year, raising the total number to 348,173 licenses.

Wholesale and retail trade and vehicle/motorcycle repair accounted for the largest share with 48,242 licenses.

Accommodation and food services followed with 16,531 licenses.

Construction ranked third with 11,521 licenses.

Qatar:

The wholesale and retail trade sector is valued at approximately 50,083 million Qatari Riyals.

There are 11,139 establishments in the wholesale and retail sector, employing 213,954 workers.

Employee compensation in the wholesale and retail sector reached 11,288,877 thousand Qatari Riyals.

The hotel and restaurant sector consists of 2,396 establishments with 78,194 employees, and total compensation of 2,947,431 thousand Qatari Riyals.

Mobile phone subscribers (standard subscriptions) reached 976,015, and prepaid service subscribers reached 2,941,556.

Newly paved roads in Qatar last year covered 2,224 kilometers.

242,923 new driving licenses were issued.

Compensation in the transport and communications sector totaled 24,338,223 thousand Qatari Riyals.

715,897 insurance policies were issued last year.

There are 4,973 business services establishments employing 215,285 workers, with compensation exceeding 15,347,819 thousand Qatari Riyals.

80,569 individuals work in the social and personal services sector within the private sector, with total compensation estimated at 6,127,645 thousand Qatari Riyals.

Kuwait:

Wholesale and retail trade contributes approximately 1,644.3 million Kuwaiti Dinars to the GDP.

Restaurants and hotels contribute around 418.6 million Kuwaiti Dinars to the GDP.

The transport, storage, and communications sector contributes approximately 2,554.5 million Kuwaiti Dinars.

The total area of paved roads in Kuwait is 91,340,068 square meters.

United Arab Emirates (UAE):

Wholesale and retail trade and motor vehicle repair account for 12.3% of the GDP (172,288 million Dirhams).

The transportation and storage sector contributes 5.9% (82,461 million Dirhams).

Accommodation and food services contribute 2.3% (32,357 million Dirhams).

The information and communications sector contributes 2.9% (41,347 million Dirhams).

Financial activities and insurance contribute 9.6% (134,773 million Dirhams).

7,584,607 insurance policies were issued by the end of last year.

Wholesale and retail trade accounts for 13% of the total workforce in the UAE.

The transportation and storage sector employs 6.2% of the total workforce, while accommodation and food services employ around 5%.

Oman:

Oman’s GDP stands at 29.3 billion Omani Riyals.

Wholesale and retail trade contribute 7% to the GDP (2,064.7 million Omani Riyals).

The restaurant and hotel sector contributes 1.1% (308.6 million Omani Riyals).

Transport, storage, and communications contribute approximately 5.9% (1,721.2 million Omani Riyals).

Global Service Sector:

The service sector is the largest contributor to global GDP, accounting for more than three-fifths of total output. Unlike manufacturing industries that produce tangible goods like automobiles and furniture, the service sector revolves around intangible services such as banking, healthcare, transportation, hospitality, and entertainment.

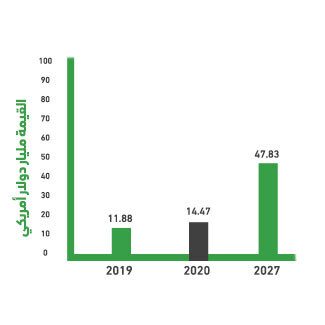

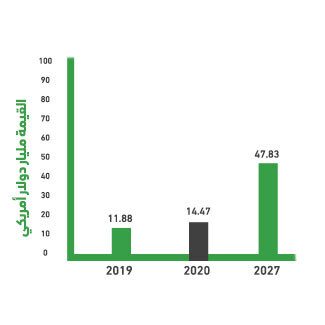

The global service sector was valued at approximately USD 10,814.49 billion in 2020.

It rose to about USD 11,780.11 billion in 2021, achieving a compound annual growth rate (CAGR) of 8.9%.

After recovering from the COVID-19 pandemic, experts project that the sector’s value will reach USD 15,683.84 billion by 2025, with an expected CAGR of 7% over the coming years.

“Mashroo3k” Consulting Company recommends investing in the service industry, as its contribution to global GDP increased from 62.8% in 2010 to 65.7% in 2020. According to World Bank data, the sector’s contribution to global GDP is expected to rise to 69.6% by 2030.