Mashroo3k Consulting Company presents a feasibility study for a G.R.C concrete factory project in the Sultanate of Oman, with the highest profit return and the best payback period, through a set of accurate studies of the Omani market size, analysis of local and foreign competitors’ strategies, and providing competitive pricing.

The G.R.C (Glassfiber Reinforced Concrete) factory offers high-performance concrete reinforced with glass fibers. This material stands out for its strength, ease of molding compared to other construction materials, and its resistance to moisture and weather conditions.

G.R.C concrete is widely used in decorative applications, building façades, and occasionally for interior walls to add an architectural aesthetic touch. It is available in various sizes and offers the same functional properties as traditional concrete but with significantly lighter weight.

Mashroo3k Consulting provides investors with comprehensive support to establish a G.R.C concrete factory in the Sultanate of Oman, utilizing state-of-the-art production lines and advanced manufacturing technology. The project also benefits from a skilled marketing team capable of developing creative strategies to penetrate and expand into new markets.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

Given the strategic importance of the construction sector, Mashroo3k Consulting presents the following key indicators across the Gulf Cooperation Council (GCC) countries:

Construction GDP Contribution: SAR 168.75 billion

Sector’s Share in GDP: 4.66%

Number of Active Companies: 148,026

Number of Employees: 3,541,977

Total Value of Executed Projects: SAR 311.56 billion

Market Position: The Kingdom holds a regional leadership position, with an annual market value exceeding USD 100 billion

Construction GDP Contribution: AED 123.95 billion

Sector’s Share in GDP: 8.3%

Number of Active Companies: 42,428

Number of Employees: 1,564,095

Construction GDP Contribution: BHD 936.79 million

Sector’s Share in GDP: 7.7%

Growth Trend: In 2016, the sector’s value was BHD 857 million, increasing to BHD 945.51 million in a few years

Construction GDP Contribution: OMR 1.943 billion

Sector’s Share in GDP: 6.7%

Number of Employees: 548,999

Employment Share:

Highest employer in Oman, accounting for 22.4% of Omani nationals in both public and private sectors

Represents 29.6% of total expatriate workforce

Construction GDP Contribution: KWD 838.9 million

Sector’s Share in GDP: 2.14%

Number of Active Companies: 1,502

Number of Employees: 187,705

Construction GDP Contribution: QAR 81.215 billion

Sector’s Share in GDP: 12.1%

Number of Active Companies: 5,629

Number of Employees: 840,999

Workforce Share: The sector employs over 40% of the economically active adult population

The construction sector remains one of the most promising investment opportunities in the GCC. With rapid population growth and ongoing infrastructure development, the sector is increasingly attractive to investors and entrepreneurs seeking high returns with lower operational complexity.

Expected Regional Market Growth Rate: 4.2% over the next three years

Forecasted Global Market Size (2023): USD 10.5 trillion

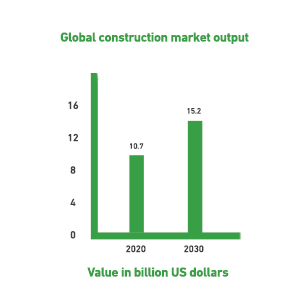

2020 Global Construction Output: USD 10.7 trillion

Forecasted Growth by 2030: +42% (USD 4.5 trillion)

Expected Output by 2030: USD 15.2 trillion

The construction sector contributes approximately 13% to the global Gross Domestic Product (GDP), and this share is expected to rise to 13.5% by 2030.

According to the available statistics, infrastructure is projected to be the fastest-growing subsector within construction, with an average growth rate of 4% between 2020 and 2030.