This project consists of a gift shop and event planning services tailored to suit all customers’ tastes. It provides full event preparation and is considered one of the successful projects with high demand, especially during seasons such as weddings, holidays, New Year’s, and other occasions. The shop also sells gifts, offers gift wrapping, engraving, and writing on gifts, and sells wedding boxes of various types and engagement presentation boxes, in addition to a wide variety of different gift sets and picture frames in various shapes.

It is a project that involves a store for selling gifts and organizing events to suit all customer tastes. Through complete event preparation, the project is among the successful ones characterized by high demand, especially during seasons such as weddings, holidays, New Year, and other occasions. The store sells and wraps gifts, offers engraving and writing on the gifts, and sells wedding boxes in various types and engagement gift boxes, in addition to a wide range of different gift sets and frames in various shapes for pictures. The store also provides a wide selection of cards for events, along with various types of candles. This project is considered one of the essential projects at present and has a significant opportunity for success if executed correctly and in the appropriate location. The demand for gifts is increasing among different segments of society, making the establishment of a gift shop and event supplies a substantial investment opportunity.

A variety of services and programs tailored to meet the needs of different target groups

A team of highly qualified specialists

Optimal communication with the customer service team

Securing clients and properties in collaboration with top security companies

Executive summary

Study of project services/products

Market Size Analysis.

The Service Sector in the Gulf Cooperation Council (GCC) Countries

According to macroeconomic sector theory, the economy is divided into three main sectors:

The first sector involves the extraction of raw materials and includes mining companies, logging companies, oil exploration firms, agricultural industries, and fishing activities.

The second sector is focused on goods production and sales, such as the automotive industry, furniture manufacturing, clothing trade, and similar activities.

The third sector, known as the “services sector,” is responsible for providing and producing services, primarily relying on intangible elements such as entertainment, healthcare, transportation, hospitality, and restaurants.

The theory suggests that as countries become more developed, their economies increasingly rely on the third sector, in contrast to less-developed countries that depend largely on the first sector. (For example, the services sector accounts for approximately 85% of the U.S. economy.)

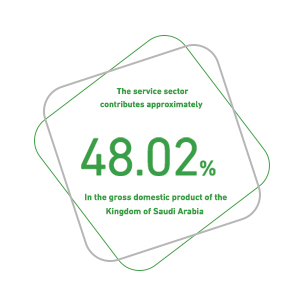

Saudi Arabia:

The service sector in Saudi Arabia is highly significant, encompassing: wholesale and retail trade, restaurants and hotels, transportation, storage, information and communications, financial services, insurance, real estate, business services, social, community, and personal services, as well as government services. Key indicators of the sector include:

The service sector contributes approximately 48.2% to Saudi Arabia’s GDP.

The “wholesale and retail trade, restaurants, and hotels” segment accounts for 10.8% of the GDP.

The “transportation, storage, information, and communications” segment contributes 6.6%.

The “financial services, insurance, real estate, and business services” segment represents 6.4% of the GDP.

The “community, social, and personal services” segment contributes 2.5%.

Government services contribute 21.9% to the GDP.

Saudi Arabia issued 100,944 new commercial licenses last year, raising the total number to 348,173 licenses.

Wholesale and retail trade and vehicle/motorcycle repair accounted for the largest share with 48,242 licenses.

Accommodation and food services followed with 16,531 licenses.

Construction ranked third with 11,521 licenses.

Qatar:

The wholesale and retail trade sector is valued at approximately 50,083 million Qatari Riyals.

There are 11,139 establishments in the wholesale and retail sector, employing 213,954 workers.

Employee compensation in the wholesale and retail sector reached 11,288,877 thousand Qatari Riyals.

The hotel and restaurant sector consists of 2,396 establishments with 78,194 employees, and total compensation of 2,947,431 thousand Qatari Riyals.

Mobile phone subscribers (standard subscriptions) reached 976,015, and prepaid service subscribers reached 2,941,556.

Newly paved roads in Qatar last year covered 2,224 kilometers.

242,923 new driving licenses were issued.

Compensation in the transport and communications sector totaled 24,338,223 thousand Qatari Riyals.

715,897 insurance policies were issued last year.

There are 4,973 business services establishments employing 215,285 workers, with compensation exceeding 15,347,819 thousand Qatari Riyals.

80,569 individuals work in the social and personal services sector within the private sector, with total compensation estimated at 6,127,645 thousand Qatari Riyals.

Kuwait:

Wholesale and retail trade contributes approximately 1,644.3 million Kuwaiti Dinars to the GDP.

Restaurants and hotels contribute around 418.6 million Kuwaiti Dinars to the GDP.

The transport, storage, and communications sector contributes approximately 2,554.5 million Kuwaiti Dinars.

The total area of paved roads in Kuwait is 91,340,068 square meters.

United Arab Emirates (UAE):

Wholesale and retail trade and motor vehicle repair account for 12.3% of the GDP (172,288 million Dirhams).

The transportation and storage sector contributes 5.9% (82,461 million Dirhams).

Accommodation and food services contribute 2.3% (32,357 million Dirhams).

The information and communications sector contributes 2.9% (41,347 million Dirhams).

Financial activities and insurance contribute 9.6% (134,773 million Dirhams).

7,584,607 insurance policies were issued by the end of last year.

Wholesale and retail trade accounts for 13% of the total workforce in the UAE.

The transportation and storage sector employs 6.2% of the total workforce, while accommodation and food services employ around 5%.

Oman:

Oman’s GDP stands at 29.3 billion Omani Riyals.

Wholesale and retail trade contribute 7% to the GDP (2,064.7 million Omani Riyals).

The restaurant and hotel sector contributes 1.1% (308.6 million Omani Riyals).

Transport, storage, and communications contribute approximately 5.9% (1,721.2 million Omani Riyals).

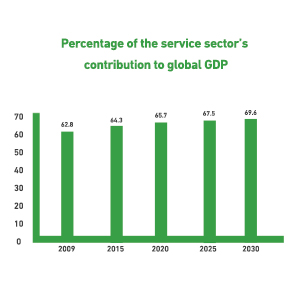

Global Service Sector:

The service sector is the largest contributor to global GDP, accounting for more than three-fifths of total output. Unlike manufacturing industries that produce tangible goods like automobiles and furniture, the service sector revolves around intangible services such as banking, healthcare, transportation, hospitality, and entertainment.

The global service sector was valued at approximately USD 10,814.49 billion in 2020.

It rose to about USD 11,780.11 billion in 2021, achieving a compound annual growth rate (CAGR) of 8.9%.

After recovering from the COVID-19 pandemic, experts project that the sector’s value will reach USD 15,683.84 billion by 2025, with an expected CAGR of 7% over the coming years.