Feasibility study for a chips and snacks factory: it is a factory for producing potato chips (chips) and snacks in various sizes of (15 grams, 18 grams, 26 grams, 135 grams, 150 grams, 185 grams, and 190 grams, as well as jumbo sizes).

Feasibility study for a chips and snacks factory: it is a factory for producing potato chips (chips) and snacks in various sizes of (15 grams, 18 grams, 26 grams, 135 grams, 150 grams, 185 grams, and 190 grams, as well as jumbo sizes). <Potato chips (crisps) are considered important and essential snacks that cannot be overlooked, and they are made using potatoes.<Where it is peeled and cut into thin slices and small pieces, then the frying process takes place, after which some preservatives, spices, and flavor enhancers are added. <Potato chips are considered products that are consumed on a daily basis and are in high demand, particularly among children and youth. The manufacturer targets various sectors, such as supermarkets, hypermarkets, and wholesale and retail stores.<The demand for the factory’s products is characterized by growth and continuity due to the increase in population as well as the rising rates of food consumption from economically viable projects.

Producing potato chips by utilizing the available resources in the Hail region, which is one of the important agricultural areas with an abundance of raw materials (potatoes).

Creating new investment opportunities with good returns.

Achieving a good return for the project owner.

Employing the workforce and improving their economic and social standards.

Generating strong cash flows and added economic value.

Optimal utilization of the project’s resources and assets.

Achieving a high level of quality.

Maintaining competitive pricing to enable the project to capture its targeted market share.

Contributing to meeting the growing demand for potato chips.

Using the latest technologies in potato chip manufacturing and training the workforce to use them.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

The Gulf Cooperation Council (GCC) countries comprise just 0.7% of the world’s population; however, they account for 3% of global spending on processed food and beverages—amounting to USD 102 billion out of a total USD 3.4 trillion. This highlights the region’s exceptionally high per capita food consumption, surpassing the global average.

This is unsurprising upon closer examination: the GCC population now exceeds 58 million people, with approximately 56.3% falling within the 25–54 age bracket—a vital and dynamic demographic that forms the backbone of the food industry market due to its youthfulness and vitality.

Saudi Arabia alone accounts for approximately 59.7% of the GCC’s total population and captures more than 53% of the food and beverage market share in the region. Accordingly, Mashroo3k Company has compiled key indicators of this vital market in the Kingdom, based on the latest available statistics:

By the end of Q2 2021, the number of food product factories was estimated at 916, with an additional 249 factories under construction.

The number of beverage factories stood at 209, with 71 more under construction.

Food product factories represented 11.1% of the total 8,258 operational factories in Saudi Arabia, while beverage factories accounted for 2.5%.

The Saudi food and beverage market was valued at SAR 168.8 billion.

By the end of 2021, food consumption reached SAR 221 billion, marking a 6% growth rate.

According to global reports, Saudi Arabia’s food consumption was valued at USD 70 billion—equivalent to 60% of the total food consumption across the Gulf region.

The fast-food market in Saudi Arabia is projected to reach USD 4.5 billion within the next three years.

The organic, healthy, and specialty food market is valued at USD 27 billion, while the halal food market stands at USD 6 billion.

Saudi Arabia imports approximately USD 14.5 billion worth of food and beverages annually.

In 2020, operating expenses for food and beverage service activities were estimated at SAR 34,032.10 million, up from SAR 30,069.23 million in 2018.

Operating revenues for food and beverage service activities reached SAR 61,557.77 million in 2020, up from SAR 54,866.87 million in 2018.

By 2027, operating expenses for food and beverage service activities are expected to reach SAR 52,489.34 million, while operating revenues are forecast to climb to SAR 92,084.64 million.

Total operating revenues for the food product manufacturing sector in Saudi Arabia are projected to reach SAR 128,540.573 million by 2027.

Global Food Sector Overview:

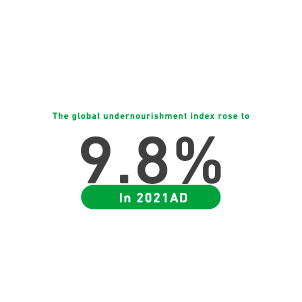

According to UNICEF, the global malnutrition rate rose to 9.8% in 2021.

Between 702 million and 828 million people are suffering from hunger worldwide.

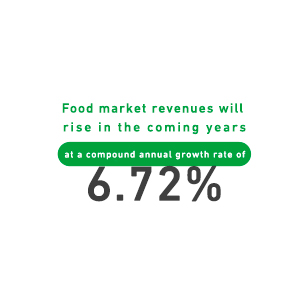

The global food market generates approximately USD 8.66 trillion in revenue.

About 7.8% of global food market revenue is expected to be generated through online sales.

Total global production of primary crops amounts to 9.4 billion tons.

Total global production of red and white meats is 337 million tons.

Total global fruit production is 883 million tons.

Total global vegetable production is 1,128 million tons.

Total global vegetable oil production is 201 million tons.

Total global dairy production stands at 883 million tons.

Total global egg production amounts to 83 million tons.

The fast-food market in Saudi Arabia is expected to reach USD 4.5 billion within the next three years.

The organic, healthy, and specialty food market in the Kingdom has reached USD 27 billion, while the halal food market is valued at USD 6 billion.

Saudi Arabia’s imports of food and beverage products are estimated at approximately USD 14.5 billion annually.

In 2020, operating expenses for food and beverage service activities were estimated at SAR 34,032.10 million, compared to SAR 30,069.23 million in 2018.

Operating revenues for food and beverage service activities reached SAR 61,557.77 million in 2020, up from SAR 54,866.87 million in 2018.

By 2027, operating expenses for food and beverage service activities are expected to reach SAR 52,489.34 million, while operating revenues are projected to reach SAR 92,084.64 million.

The total projected operating revenues for the food product manufacturing sector in Saudi Arabia are expected to reach SAR 128,540.573 million by 2027.