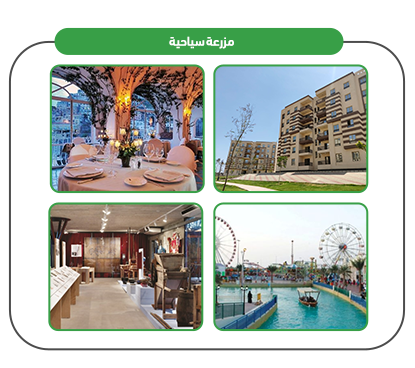

The project is an investment in the field of agricultural tourism through a farm containing small residential units in an environmental style inspired by the natural rural environment and providing recreational areas for guests to spend holidays in rural houses. The farm’s services are limited to providing large areas of agricultural areas characterized by picturesque and distinctive views, providing residential units equipped to the highest level, restaurants, recreational areas, shops selling rural products, a small museum that renews the history of fathers and grandfathers, and providing some products from within the farm to guests. The project targets many categories and sectors such as: tourists, foreigners, businessmen, as well as private companies and government institutions.

Mashroo3k Economic and Management Consulting Company is conducting a feasibility study for a tourist farm, by studying the market size that requires the farm’s services, which are determined by: (providing large areas of agricultural areas that are characterized by picturesque and distinctive views – providing residential units equipped to the highest standard – restaurants – entertainment venues – shops selling rural products – a small museum that renews the history of fathers and grandfathers – providing some products from within the farm to guests). The farm works to provide its services with the highest level of quality and it also provides these services at prices that are not acceptable to compete in the tourist farm market. The farm seeks to benefit from the growth of the market size to the maximum extent possible and meet all its needs for services provided in the farm’s rural houses, which it relies on to provide on a selected elite of human cadres (workers – employees – administrators).

The presence of high-quality residential buildings, paved pedestrian paths, good lighting, and water services, etc.

Agricultural recreation is available, including the enjoyment of participating in agricultural activities such as harvesting crops and practicing rural customs and traditions.

Some farm produce is offered to all guests.

Some educational and sports activities are available for tourists.

Availability of air-conditioned vehicles and mosques.

A complete security system.

ATM machines.

Telephone services.

A first aid center.

Accessibility services for people with special needs are available.

The design of the accommodation units is compatible with the nature and appearance of the farm.

General environmental preservation.

Providing a mechanism for connecting all services to the accommodation facilities without harming the farm.

Developing a range of activities for lodge residents and engaging them with them by the lodge administrators, such as participating in planting, fruit harvesting, and other activities.

Attempts are made to extend activities beyond the farm by facilitating visits to markets and festivals.

Place the shelters in the quietest areas of the farm, taking into account the provision of parking and other basic needs.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

The Tourism Sector in the GCC Countries

The tourism sector is considered one of the most important contributors to global GDP. Its direct contribution represents 3.3% of the total global GDP, while its total contribution stands at 10.4%, amounting to USD 9.2 trillion. It is worth noting that jobs in the tourism sector represent 10.6% of total employment globally (334 million jobs), and global spending on leisure travel is estimated at around USD 2.37 trillion. The sector continues to grow steadily, to the extent that it creates one out of every four new jobs worldwide. This is a brief overview of global tourism indicators.

As for the tourism indicators in the Gulf Cooperation Council (GCC) countries, they are as follows:

The total number of inbound tourists to GCC countries reached 43.8 million, with an annual decline rate of 0.3% over a five-year period.

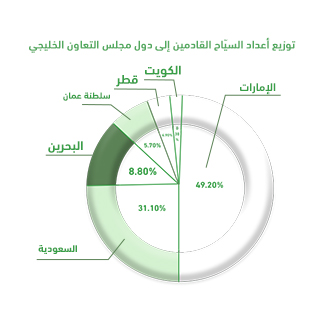

If we consider the distribution of inbound tourists to GCC countries in percentage terms, the United Arab Emirates alone accounted for approximately 49.2%, followed by Saudi Arabia with 31.1%. The chart below shows how the remaining tourists are distributed among the other GCC countries.

Tourist spending in the GCC countries recorded a consecutive growth of 12.1%, reaching USD 81.1 billion.

The UAE alone accounts for 47.30% of the total spending by inbound tourists to the GCC countries.

The total number of nights spent by tourists in the GCC countries reached 303.2 million nights, with Saudi Arabia accounting for 57.4% of those nights.

The total number of domestic (intra-GCC) tourists reached approximately 12.6 million individuals.

Intra-GCC tourism represented 28.7% of the total number of inbound tourists to the region. It is worth highlighting that Bahrain received the highest share of these intra-GCC tourists, with a remarkable 95.6%.

According to a publication by the GCC Statistical Center, the total number of hotel establishments across GCC countries reached 11,119.

The total number of rooms in these establishments amounted to approximately 620,517, with a projected growth rate of 2.3%.

The leisure and hospitality construction market in the GCC is expected to reach USD 642.3 billion by 2023.

According to the United Nations World Tourism Organization (UNWTO), GCC countries are expected to welcome 195 million visitors by the year 2030.

There is no doubt that the COVID-19 pandemic had a significant impact on global travel and tourism indicators, causing the sector’s contribution to global GDP to decline to just 6.1%, down from 10.3% in the year prior to the pandemic. However, the sector has recently begun to recover, and global indicators confirm this upward trend. Therefore, Mashroo3k Consulting recommends investing in this vital sector, based on the following factors:

According to the UN World Tourism Organization (UNWTO), the number of international tourists rose from 25.2 million in 1950 to 1.40 billion after 68 years.

By the end of 2021, a total of 2,246 hotels were opened worldwide. This number was expected to reach 2,805 hotels by the end of 2022, and 2,934 hotels by the end of 2023.

In 2021, 340,700 hotel rooms were opened globally. This number was expected to rise to 428,000 by the end of 2022, and to 447,600 by 2023.

By the end of 2021, the global tourism sector saw a 21.7% increase in its contribution to global GDP compared to the previous year, when the pandemic had severely impacted the industry. The sector’s contribution reached approximately USD 5.81 trillion.

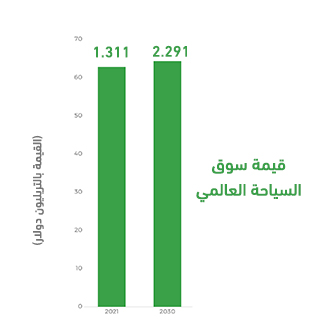

The global tourism market was valued at approximately USD 1.311 trillion, and it is projected to grow to USD 2.291 trillion by 2030 (excluding the pandemic’s impact year).