The Vocational Training Center Project is a specialized institution that aims to prepare and qualify individuals for the labor market by offering advanced educational and training programs that meet the needs of various sectors. The center seeks to enable trainees to acquire the skills and knowledge necessary to develop their capabilities, whether they wish to start their careers, improve their job performance, or even develop their own businesses. The programs offered by the Vocational Training Center Project vary, including behavioral courses that focus on developing communication skills and teamwork, administrative courses that cover leadership and time management, in addition to technical programs that address specialized professions such as crafts and industries. The center also places special emphasis on promoting a culture of entrepreneurship through programs that help trainees establish and successfully manage their startup projects. The center is distinguished by its ability to keep pace with changes in the labor market, constantly adding new educational programs that cover emerging jobs and professions. It is keen to provide an interactive learning environment using the latest training methods, making it an ideal destination for those seeking to develop themselves and achieve their professional ambitions.

The Vocational Training Center project is an integrated institution that aims to prepare individuals for the labor market by offering comprehensive training programs that combine theoretical education with practical application. The center offers courses in various fields, such as behavioral skills, management development, and technical specializations, in addition to entrepreneurship programs that enable individuals to establish and manage their own projects. The training process is supervised by a team of qualified, experienced, and highly skilled trainers, ensuring the provision of distinguished training content that meets the needs of the evolving labor market. The center also provides an integrated educational environment equipped with the latest tools and technologies, which contributes to enhancing the learning experience and practical application of acquired skills. The center is keen to provide opportunities for everyone by offering relatively low training fees, making it an ideal choice for those seeking to develop their professional skills.

Providing the best educational services at reasonable fees.

A team of highly qualified and experienced trainers.

Providing an educational environment equipped with the latest tools and the best staff.

Balancing theoretical and practical aspects.

Preparing individuals to meet the demands of the labor market.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

The Service Sector in the GCC Countries

According to macroeconomic sector theory, the economy is divided into three major sectors:

The first sector focuses on raw material extraction and includes industries such as mining, lumber, oil exploration, agriculture, and fishing.

The second sector is based on goods production and sales, such as automobile manufacturing, furniture, clothing trade, and more.

The third sector, known as the services sector, is responsible for providing and producing services, relying primarily on intangible outputs such as entertainment, healthcare, transportation, hospitality, and restaurants.

This theory suggests that the more advanced a country becomes, the more its economy relies on the third sector, in contrast to primitive economies that depend heavily on the first sector. For example, the services sector accounts for about 85% of the United States’ economy.

The service sector is a significant component of the Saudi economy, encompassing: wholesale and retail trade, restaurants and hotels, transport, storage, information and communications, financial services, insurance, real estate, business services, as well as community, social, personal, and government services.

Key indicators for Saudi Arabia’s service sector:

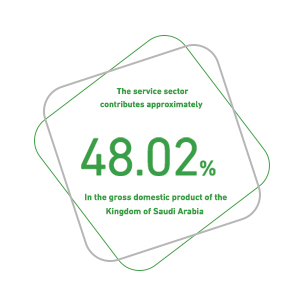

The services sector contributes approximately 48.2% to the Saudi GDP.

“Wholesale, retail trade, restaurants, and hotels” activities contribute 10.8% to the GDP.

“Transport, storage, information, and communications” activities contribute 6.6% to the GDP.

“Financial services, insurance, real estate, and business services” contribute 6.4%.

“Community, social, and personal services” activities contribute 2.5%.

“Government services” contribute 21.9% to the GDP.

According to the latest statistics, Saudi Arabia issued 100,944 new commercial licenses last year, bringing the total to 348,173 commercial activity licenses.

Wholesale and retail trade and motor vehicle and motorcycle repair activities accounted for the largest share with 48,242 licenses.

Accommodation and food services activities followed with 16,531 licenses.

Construction activities ranked third with 11,521 licenses.

The value of the wholesale and retail trade sector is approximately QAR 50,083 million.

There are 11,139 establishments engaged in wholesale and retail trade, employing 213,954 workers.

Workers’ compensation in the wholesale and retail sector reached approximately QAR 11,288.877 million.

The hotel and restaurant sector comprises 2,396 establishments with 78,194 employees.

Workers’ compensation in the hotel and restaurant sector amounts to QAR 2,947.431 million.

There are 976,015 mobile phone postpaid subscribers and 2,941,556 prepaid subscribers.

2,224 kilometers of roads were paved last year.

242,923 driving licenses were issued in the past year.

Workers’ compensation in the transport and communication sector totaled QAR 24,338.223 million.

715,897 insurance policies were issued during the past year.

There are 4,973 establishments engaged in business services activities employing 215,285 workers.

Workers’ compensation in business services activities exceeded QAR 15,347.819 million.

80,569 employees work in private-sector social and personal services activities, with workers’ compensation estimated at QAR 6,127.645 million.

The wholesale and retail trade sector contributes approximately KWD 1,644.3 million to the national GDP.

The accommodation and food services sector contributes about KWD 418.6 million.

Transport, storage, and communications activities contribute approximately KWD 2,554.5 million.

The total area of paved roads in Kuwait measures about 91,340,068 m².

Wholesale and retail trade, and motor vehicle and motorcycle repair activities contribute 12.3% to the GDP (AED 172,288 million).

Transport and storage activities contribute 5.9% to the GDP (AED 82,461 million).

Accommodation and food services activities contribute 2.3% (AED 32,357 million).

Information and communications activities contribute 2.9% (AED 41,347 million).

Financial and insurance activities contribute 9.6% (AED 134,773 million).

A total of 7,584,607 insurance policies were issued by the end of last year.

Wholesale and retail trade activities account for 13% of the UAE’s total workforce.

Transport and storage activities employ about 6.2% of the workforce, while accommodation and food services employ approximately 5%.

The national GDP stands at approximately OMR 29.3 billion.

Wholesale and retail trade activities contribute 7% to the GDP (OMR 2,064.7 million).

Accommodation and food services activities contribute 1.1% to the GDP (OMR 308.6 million).

Transport, storage, and communications activities contribute around 5.9% to the GDP (OMR 1,721.2 million).

The service sector is the largest contributor to global GDP, accounting for more than three-fifths of the total output. Unlike manufacturing sectors that produce tangible goods like cars and furniture, the services sector provides intangible services such as banking, healthcare, transportation, hospitality, and entertainment.

The sector’s market value was estimated at approximately USD 10,814.49 billion in 2020, rising to USD 11,780.11 billion in 2021, achieving a compound annual growth rate (CAGR) of 8.9%.

Following recovery from the COVID-19 pandemic, global market experts project that the services sector will reach USD 15,683.84 billion by 2025, reflecting an anticipated CAGR of 7% in the coming years.

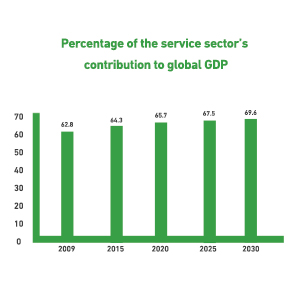

Mashroo3k Consulting recommends investing in the services industry, as its contribution to global GDP increased from 62.8% in 2010 to 65.7% in 2020. According to World Bank data, this industry’s contribution to global GDP will rise to 69.6% by 2030.