Mashroo3k Economic Consulting Company presents a feasibility study for a floating restaurant project in the Sultanate of Oman, with the highest profit return and the best payback period, through a thorough analysis of the tourism and entertainment sector in the Sultanate of Oman, as well as an analysis of local competitors’ strategies and the feasibility of offering competitive pricing and services.

The feasibility study for a floating restaurant project is being carried out by Mashroo3k Company for Economic and Administrative Consulting, and it is clear from the market analysis and research, as well as the preparation of the technical and financial study of the project, that there is a demand for the services identified by the company’s team of experts and consultants. The project will offer Eastern and Western cuisines, and a variety of hot and cold beverages, serving main meals for breakfast, lunch, and dinner on the ship, allowing customers to enjoy a sightseeing tour while having their meals. The restaurant’s decor will be traditional, reflecting authenticity, providing visitors with an unforgettable charming impression.

The restaurant offers services at competitive prices suitable for all targeted sectors, and provides them at the highest possible level of quality in accordance with globally adopted standards, relying on the best human resources and utilizing the finest dining tools and the latest equipment in meal service. This is in response to the increasing demand for restaurant services, driven by population growth, rising individual living standards, and increased welfare. The restaurant aims to capture a significant share of the marketing gap and benefit from the development and growth of market size.

Variety of services offered by the project: A diverse range of services to cater to different customer preferences.

The meals served by the floating restaurant are exceptional: Breakfast, lunch, and dinner options that stand out.

Meals from all international cuisines (Arabic, International): A wide variety of dishes from various global cuisines.

The restaurant takes tourists on a sightseeing tour along the Corniche while enjoying their meals: Combining dining with a scenic tour for a unique experience.

The restaurant’s prices are very competitive compared to others: Offering attractive pricing for customers.

Open buffet: A buffet offering a wide variety of food options.

Availability of romantic ambiance with poetic music and dim lighting when hosting guests in the floating restaurant: Creating a cozy and romantic atmosphere for a memorable dining experience.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

In recognition of the role of the entertainment sector in building non-oil-based economies, Mashroo3k Consultancy Company presents the following key indicators of the sector in the Gulf Cooperation Council (GCC) countries:

According to the latest statistics, the number of museums in the GCC countries is 306, with the number of visitors reaching 6,032,840.

The number of hotel establishments in the GCC is 11,119.

The number of entertainment events reached 690, with a total of 9,784 days. The number of attendees at these events was 34,699,458 individuals.

The number of museums related to archaeology, history, and heritage is 33.

The number of private museums is 195.

There are 8,499 archaeological sites, with 178,020 visit permits issued annually for these sites.

It is expected that the entertainment sector will contribute 4.2% to Saudi Arabia’s GDP in the coming years.

The number of museums reached 41, with 2,322,807 visitors.

There are 260 public parks.

The number of museums in Oman has reached 12, with the number of visitors exceeding 408,000.

Oman has 51 forts and castles, with 427,000 visitors to these historic sites.

The number of sports facilities reached 291, with the majority being football stadiums (90 stadiums) and 37 covered halls in second place.

There are 99 cinemas with a total seating capacity of 14,108 seats. The total number of films shown in these cinemas, according to the latest statistics, is 3,549.

The total annual number of visitors to museums and exhibitions in Qatar is 1,038,470.

The number of visitors to the Kuwait Tourism Projects Company, which offers various recreational services, was 1,308,514 individuals.

The number of visitors to museums in Kuwait is 108,987.

Kuwait has 814 libraries, with the total number of classified books exceeding 2,087,513.

The GCC Governments’ Efforts:

The governments of the GCC countries aim to improve the quality of life and provide a high level of well-being for their citizens by investing in the entertainment sector. In recent years, these governments have adopted initiatives to increase the number of parks, live entertainment shows, and encourage visual and audio arts.

It is expected that the entertainment and hospitality construction market in the GCC will reach USD 642.3 billion by 2023, compared to an estimated market value of USD 466.9 billion in 2019.

According to the United Nations World Tourism Organization, the GCC is expected to receive 195 million visitors by 2030.

In 2021, the global entertainment and media market reached a value of USD 2.34 trillion, and it is expected to grow at a compound annual growth rate (CAGR) of 4.6%, reaching USD 2.93 trillion by 2026.

The consultancy firm “Mashroo3k” recommends investing in the entertainment sector based on the following points:

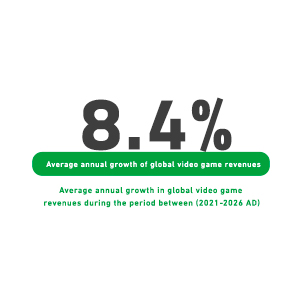

In 2021, global video game revenues reached $214.2 billion, and they are expected to rise to $321.1 billion.

Global cinema revenues are predicted to grow at an average rate of 20.4% between 2021 and 2026.

According to Citibank’s forecasts, investment opportunities in the metaverse are expected to reach $13 trillion by 2030.

Global spending on Virtual Reality (VR) rose by 36.5% in 2021, reaching $2.6 billion. This spending is projected to grow at a compound annual growth rate (CAGR) of 24.1% between 2021 and 2026, reaching $7.6 billion.

The average annual growth rate for revenues from console games is expected to be 2.2% between 2021 and 2026.

The average annual growth rate for revenues from PC games is expected to be 4.6% between 2021 and 2026.