mashroo3k Consulting Company offers a feasibility study for a tourism investment company project in the Sultanate of Oman. The company leases and manages tourist hotels in a sophisticated manner, achieving the highest return on investment and the best payback period. This is achieved through a series of in-depth studies of the size of the Omani market, an analysis of the strategies of local and foreign competitors, and the provision of competitive pricing.

The concept of tourism has evolved in recent years, as people’s travel needs have evolved. A tourist is no longer someone carrying a suitcase, wandering around a country’s historical landmarks, and spending several nights in a hotel. Modern tourism has expanded beyond these boundaries. Modern types of tourism include medical tourism, ecotourism, marine tourism, conference tourism, shopping tourism, sports tourism of all kinds, recreational tourism, and religious tourism. mashroo3k Consulting Company provides investors interested in investing in a tourism investment company project in the Sultanate of Oman with a set of specialized feasibility studies based on up-to-date databases specific to the Omani market. These studies help ensure the project’s success, achieve the highest return on investment, and provide the best payback period.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

The Tourism Sector in the GCC Countries

The tourism sector is considered one of the most important contributors to global GDP. Its direct contribution represents 3.3% of the total global GDP, while its total contribution stands at 10.4%, amounting to USD 9.2 trillion. It is worth noting that jobs in the tourism sector represent 10.6% of total employment globally (334 million jobs), and global spending on leisure travel is estimated at around USD 2.37 trillion. The sector continues to grow steadily, to the extent that it creates one out of every four new jobs worldwide. This is a brief overview of global tourism indicators.

As for the tourism indicators in the Gulf Cooperation Council (GCC) countries, they are as follows:

The total number of inbound tourists to GCC countries reached 43.8 million, with an annual decline rate of 0.3% over a five-year period.

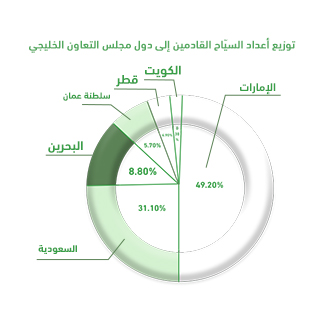

If we consider the distribution of inbound tourists to GCC countries in percentage terms, the United Arab Emirates alone accounted for approximately 49.2%, followed by Saudi Arabia with 31.1%. The chart below shows how the remaining tourists are distributed among the other GCC countries.

Tourist spending in the GCC countries recorded a consecutive growth of 12.1%, reaching USD 81.1 billion.

The UAE alone accounts for 47.30% of the total spending by inbound tourists to the GCC countries.

The total number of nights spent by tourists in the GCC countries reached 303.2 million nights, with Saudi Arabia accounting for 57.4% of those nights.

The total number of domestic (intra-GCC) tourists reached approximately 12.6 million individuals.

Intra-GCC tourism represented 28.7% of the total number of inbound tourists to the region. It is worth highlighting that Bahrain received the highest share of these intra-GCC tourists, with a remarkable 95.6%.

According to a publication by the GCC Statistical Center, the total number of hotel establishments across GCC countries reached 11,119.

The total number of rooms in these establishments amounted to approximately 620,517, with a projected growth rate of 2.3%.

The leisure and hospitality construction market in the GCC is expected to reach USD 642.3 billion by 2023.

According to the United Nations World Tourism Organization (UNWTO), GCC countries are expected to welcome 195 million visitors by the year 2030.

There is no doubt that the COVID-19 pandemic had a significant impact on global travel and tourism indicators, causing the sector’s contribution to global GDP to decline to just 6.1%, down from 10.3% in the year prior to the pandemic. However, the sector has recently begun to recover, and global indicators confirm this upward trend. Therefore, Mashroo3k Consulting recommends investing in this vital sector, based on the following factors:

According to the UN World Tourism Organization (UNWTO), the number of international tourists rose from 25.2 million in 1950 to 1.40 billion after 68 years.

By the end of 2021, a total of 2,246 hotels were opened worldwide. This number was expected to reach 2,805 hotels by the end of 2022, and 2,934 hotels by the end of 2023.

In 2021, 340,700 hotel rooms were opened globally. This number was expected to rise to 428,000 by the end of 2022, and to 447,600 by 2023.

By the end of 2021, the global tourism sector saw a 21.7% increase in its contribution to global GDP compared to the previous year, when the pandemic had severely impacted the industry. The sector’s contribution reached approximately USD 5.81 trillion.

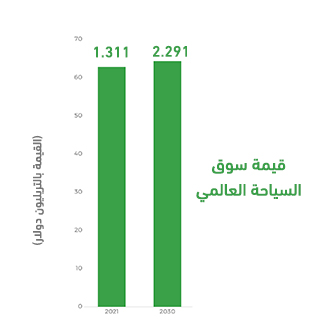

The global tourism market was valued at approximately USD 1.311 trillion, and it is projected to grow to USD 2.291 trillion by 2030 (excluding the pandemic’s impact year).